During the first module of the Master in Finance, students will learn notions of:

- Managerial Economics

This module aims to prepare students by providing them with the essentials of entrepreneurship and business planning. - Entrepreneurship and Business Planning

With this module, the managerial skills required to understand a Business Plan and its structure will be developed. - Business Strategy

Through this module, students will know how to understand the long-term direction and strategy of a company, and will be able to identify the strategic business units of organizations. - Accounting & Budgeting

This module is aimed at students understanding the importance of financial management and control principles, with key indicators such as ROI, EBIT, GAAP. - Project & Operations Management

With this module, students will be able to manage projects, examine data and information, and have a diagnostic approach in solving problems. - Marketing: Traditional and Digital

Students will learn the application of marketing principles in organizational decision making. - Human Resource Management

This subject area focuses on strategic human resource issues such as workforce acquisition, development, motivation and retention. - Data Analytics for Managers

This course is designed to equip students with the basic knowledge needed to analyze and interpret large sets of data, to make effective business decisions and strategies.

During the second module, students will learn:

1)Introduction to Financial Management

- Firms and the Financial Markets

- Financial Statement Analysis

- Banking Systems (Central Banks, IMF, Alternate Payment Systems)

- Day Trading Stocks and Options (guest lecture)

2)Valuation of Financial Assets

- The Time Value of Money

- Risk and Return—Capital Market Theory

- Interest Rates and Debt Valuation

- Investment Decision Criteria

- Securities Valuation

3)Capital Budgeting

- Financial Research, Forecasting and Planning

- Analyzing Project Cash Flows

- Risk Analysis and Project Evaluation

- Securities Law and Bankruptcy Legal Issues

4)Capital Structure, Liquidity and Payout Policy

- The Cost of Capital and Capital Structure Policy

- Dividend, Share Repurchase and Tax Policy

- Financial Distress, Managerial Incentives, and Information

- CFO Job and Capital Allocation Decisions

- Working Capital Management

- Corporate Risk Management

During the third module of the Master in Finance, students will explore:

5)Investment Vehicles

- Derivatives

- Real Estate Finance

- International Business Finance

- Mergers and Acquisitions

- Hedge Fund Style Investing/Arbitrage/Portfolio Theory and Management

6)Innovation and Sustainability in Finance

- Financial Statistics & Econometrics

- Financial Mathematics

- Big Data, AI and Fintech

- Cryptocurrencies, Tokens, and Other Alternative Payment Systems

- Sustainable Finance and Venture Capital Investing in Finance

- Programming Tools for Finance (Guest lecture)

- Building ethical and responsible organizations

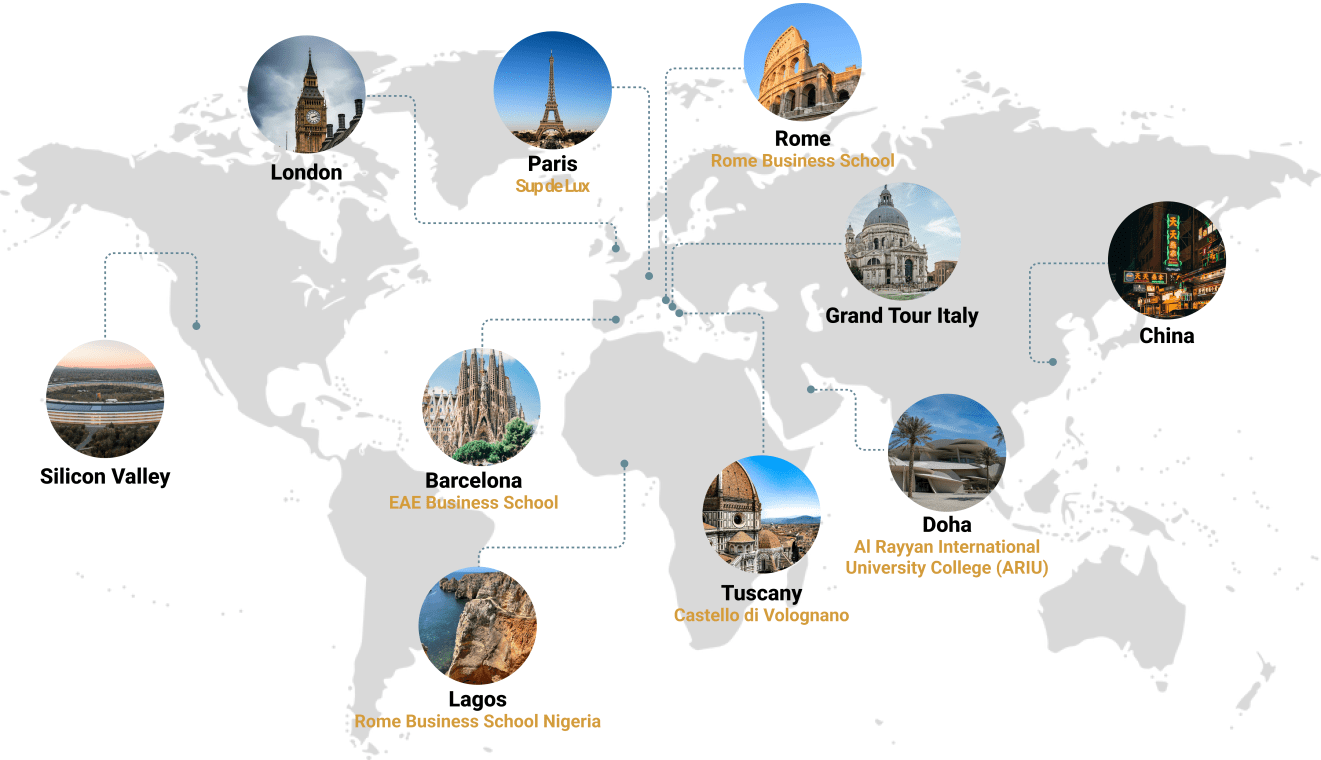

The goal of Rome Business School is to develop future managers, entrepreneurs, and professionals who are ready to capitalize on the benefits of digitalization, go global, and have a positive impact on society.

Electives are ideal tools for students to improve their employability by focusing on high-demand skills.

- Electives assist students in carving out a niche for themselves and becoming more competitive.

- Electives expose students to courses they might not have encountered otherwise.

- Electives provide a one-of-a-kind curriculum that fosters life and career skills.

- Elective courses are organized in 7 main areasof interest:

Macro Area I

Next Gen Business: Innovation, AI and Digital Growth

- Area 1: Innovation & Growth

- Area 2: AI4 Business: Shaping the Future

- Area 3: Tech & Digitalization

Macro Area II

Global Business Excellence

- Area 4: Industry Business Excellence

- Area 5: International Business

- Area 6: Global Electives with RBS international partner Business Schools

- Area 7: Introduction to preparation for professional certifications

Rome Business School Practice Lab is the place where theoretical concepts are put in practice and participants learn through experience. The Lab is run by KPMG managers who will examine different specialist knowledge, work on exercises and network, while sharing their experience and expertise with the students. This Lab is entirely run by KPMG managers with whom you will create a strategy to guide customer’s throught the customer’s journey of KPMG.

The Global Trends lab consists of 2 virtual sessions:

Session 1: How to Find Sources to Identify Global Trends Identify sources and monitor Global trends Deep Dive into the Global World Trends Shaping the World of Today – guest speakers from UN, UNIDO, ILO. Examples of Global Trends:

- The Future of Work

- Ethics of AI and Big Data

- The World in 2030: Future Scenarios

Session 2: Understand the impact of global trends on businesses, and explore ways in which businesses can adapt and transform based on future trends and forward-thinking strategies

At the conclusion of your course, you will have the opportunity to demonstrate your skills by taking on a genuine business problem. Utilize your skills to spot chances and develop a strategy that is genuinely creative.

Take on a genuine business challenge. You might decide to work in a small group, come up with an online sales plan, or design a loyalty programme for various generations.

Two case studies from two genuine firms will be provided to you so that you can put your master’s course knowledge to the test.

Previous years’ experiences

The Practical Challenge: